- As scams become increasingly sophisticated, with tactics like AI-powered voice cloning, staying vigilant and aware of evolving threats is crucial to protect yourself in 2024.

v - Some of the top scams in 2024 to look out for include easy online job scams, government account takeover scams, and deepfake and AI scams. Find out how they work and how to spot them.

v - Find out the various psychological tactics that scammers use to lure victims into falling for their scams.

v - Being vigilant and practicing a healthy level of skepticism is the best way to protect yourself from scams. Using a VPN for Chrome when browsing online hides your real IP address, so scammers know less about you.

v

- Bonus: Look out for six sure-fire signs of a scam.

As we enter 2024, scams continue to evolve with increasingly sophisticated tactics.

In 2023, we witnessed the rise of the “pig butchering” scam, in which scammers gradually built trust with their victims before enticing them into ever-larger cryptocurrency investments, only to disappear with their money.

Additionally, using AI technology to create voice cloning scams marks a new era in fraudulent activities. This technology allows scammers to produce highly convincing audio simulations, impersonating familiar voices to trick people into disclosing confidential information or making financial transfers.

These advancements underscore the importance of staying vigilant against the latest tricks up scammers’ sleeves. Whether it’s the lure of easy money, government account takeovers, or the manipulative use of generative AI, scammers are relentlessly finding new ways to exploit our vulnerabilities.

To better understand these threats and how to protect yourself—because, let’s face it, getting scammed isn’t part of anyone’s New Year’s resolutions—we turned to Aaron Engel, ExpressVPN’s Chief Security Information Officer. Engel sheds light on potential scamming trends in 2024 and provides essential tips for safeguarding against these increasingly complex schemes.

Jump to…

Navigating the surge of scams in the U.S.

Staying ahead of scams: 10 scams to look out for in 2024

1. Easy online job scams

2. Government account takeovers

3. Deepfakes and the use of generative AI

4. Peer-to-peer (P2P) payment scams

5. Package delivery scam

Other scams to be aware of in 2024

Understanding the psychology of what makes people fall for scams

What are the warning signs of a scam?

Navigating the surge of scams in the U.S.

In recent years, the U.S. has seen an alarming surge in scams, with a sharp increase in financial losses due to fraudulent activities. A Federal Trade Commission (FTC) report reveals a staggering loss of over 8.7 billion USD by Americans to scams over the past three years. This spike not only signals the growing cunning of scam artists but also the expanding scope of their operations.

Social media platforms: a hotbed for scams

Social media platforms were hotbeds for scam activities in 2023, with Americans losing 2.7 billion USD to social media scams alone. Fraudsters are increasingly leveraging these platforms, exploiting the trust and extensive reach they offer to ensnare unsuspecting victims.

These developments stress the need for heightened vigilance in our digital lives. The evolving complexity of scams, especially those woven into the fabric of platforms like social media, demands that we remain ever alert. Recognizing scam types, spotting warning signs, and understanding self-protection strategies have never been more important.

This trend also emphasizes the vital role of regulatory bodies and consumer protection agencies. Their continued and enhanced efforts are crucial in addressing these challenges and protecting the public against these sophisticated digital threats.

Staying ahead of scams: 10 scams to look out for in 2024

But until comprehensive measures are fully implemented, the onus is on us to stay informed about the latest scams and educate ourselves proactively. To give us an edge, Engel explains what he believes will be the most prominent scams to watch out for in 2024.

1. Easy online job scams

There’s a notable influx of job seekers in the early months of the new year, particularly January and February. This period coincides with an increase in job scams, especially targeting those searching for flexible or additional income opportunities These scams are particularly insidious as they exploit the common desire for easy, lucrative opportunities, often requiring minimal qualifications or experience and bypassing traditional recruitment processes like interviews.

Take, for example, the case of a recent graduate looking for part-time work. She came across an online job posting for a data entry position that promised attractive pay for minimal work. The job required no prior experience, and the application process was unusually swift, with no interview. Excited by the prospect, she applied and was quickly “hired.” However, the job was a mirage. After providing her details, including her resume and Social Security number, the company disappeared, and the graduate later found her information was used for identity theft.

Protect yourself from online job scams:

- Research thoroughly: Verify the legitimacy of the company offering the job. Check for an official website, a physical address (if applicable), and authentic employee reviews. If possible, reach out to current employees to confirm the validity of the job offer.

- Don’t fall for flattery: Fake recruitment emails could be enticing—but pause before you click. If you receive an email or message with a link, only click on it if you’re sure of its legitimacy.

- Don’t give out your details: Phishing is a common tactic used to steal personal information. If you are asked to provide your information early on, consider whether it’s a scam.

2. Government account takeover scams

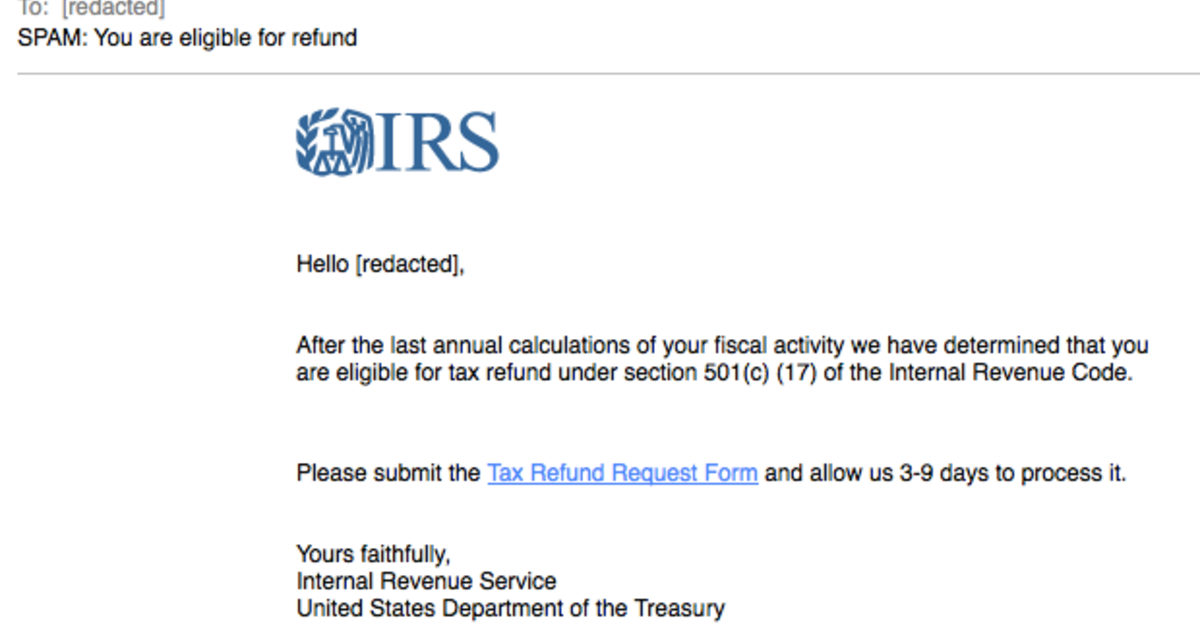

As government agencies increasingly digitize their services, a new threat has emerged in the digital landscape: government account takeover (ATO) scams. These scams represent a significant challenge as they exploit vulnerabilities in digital government services, posing a risk to the personal information of countless individuals.

A prime example of this type of scam is the fraudulent IRS email (see above). This email, masquerading as an official communication, falsely informs recipients that they are eligible for a refund. It urges them to click a link and enter sensitive details to “verify” their account. Unfortunately, this action can lead to the compromise of personal data, as scammers use this information for nefarious purposes.

Engel highlights a key vulnerability exploited in these scams.“To access a website or app, you usually need a combination email, username, or phone number, a password, and a multi-factor authentication,” he notes.

Engel emphasizes that the tendency to reuse usernames and passwords across different sites can leave individuals particularly vulnerable. Scammers often use this oversight to their advantage, obtaining these reused credentials from one compromised site and attempting to access other accounts, including those on government platforms.

It is much safer to use two-factor authentication, where a one-time code is sent to you to use alongside your password. But Engel explains that scammers may employ social engineering tactics to obtain your 2FA code. They might pose as government officials or use other deceptive means, such as the promise of a refund, to trick individuals into divulging this critical information.

What’s worse is that in 2024, AI is expected to play a bigger role in the evolution of phishing scams. AI-powered phishing attacks are expected to be more sophisticated, personalized, and difficult to identify. Understanding and preparing for these advanced threats is essential for individuals to enhance their awareness and strengthen their defenses against these advanced cybersecurity threats.

Protect yourself from government ATO scams:

- Vigilance is key: Always be cautious with unsolicited communications from government agencies, particularly those that request sensitive information or urge immediate action. Many scammers use phishing emails that look legitimate in an attempt to gain user details. Confirm the authenticity of such messages by visiting the official government website or contacting the agency through known, reliable channels.

- Use a VPN for enhanced security: When communicating with someone, it’s safer to turn on your VPN to keep your IP address (and thereby your real location) private.

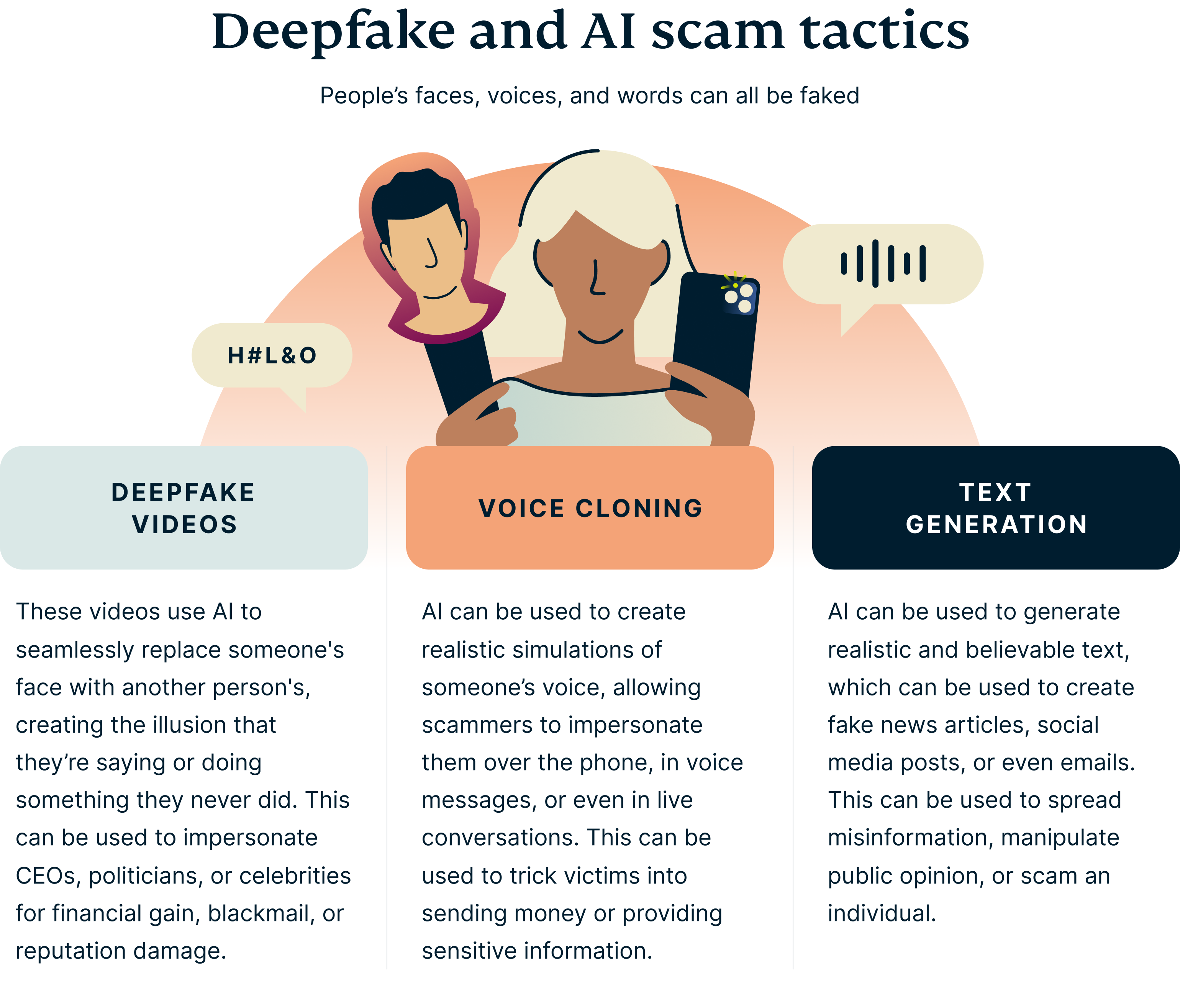

3. Deepfakes and the use of generative AI

Generative AI has helped multiple sectors, such as healthcare, finance, and entertainment. However, its potential for misuse is becoming increasingly evident, particularly in the realm of scams and sophisticated fraud.

Deepfakes, a notorious application of generative AI, enable the creation of highly realistic and convincing media, including videos, images, and audio recordings. Picture a scenario where you receive a video call from someone impersonating your bank manager, urgently requesting your account information, or an audio message from a loved one asking for financial help. A noteworthy example reported by the New York Times detailed how high-net-worth individuals were targeted using voice clones created from their publicly available audio samples. These cloned voices were then used to defraud banks, showcasing the high level of sophistication in these scams.

According to Engel, AI can also empower individuals with limited language skills to refine their scamming techniques. “In theory, AI is all just content creation but at a higher level and degree than what was possible in the past, with a lower barrier for entry. This makes it more accessible,” he explains. As technology advances, we can expect AI-led scams to become widely used, increasingly intricate, and challenging to detect.

Protect yourself from AI-enhanced scams:

- Verify your contact’s identity: If you receive a suspicious call or message, especially one that seems out of character for the supposed caller or sender, pause and verify the person’s identity through a known number or alternate communication channel.

- Report suspicious activity: If you suspect you’ve been targeted by a voice-cloning or deepfake scam, report it to the authorities immediately and block the contact.

- Learn how to spot a deep fake: While many deepfakes are convincing, there are still ways to spot them. Some visual cues include poor blending of facial features, like the inconsistencies in skin tone, shadows, or even blurry and distorted areas of the face. Audio clues can include flat or robotic intonation, like a lack of natural inflection, emotion, or even abrupt breaks in speech.

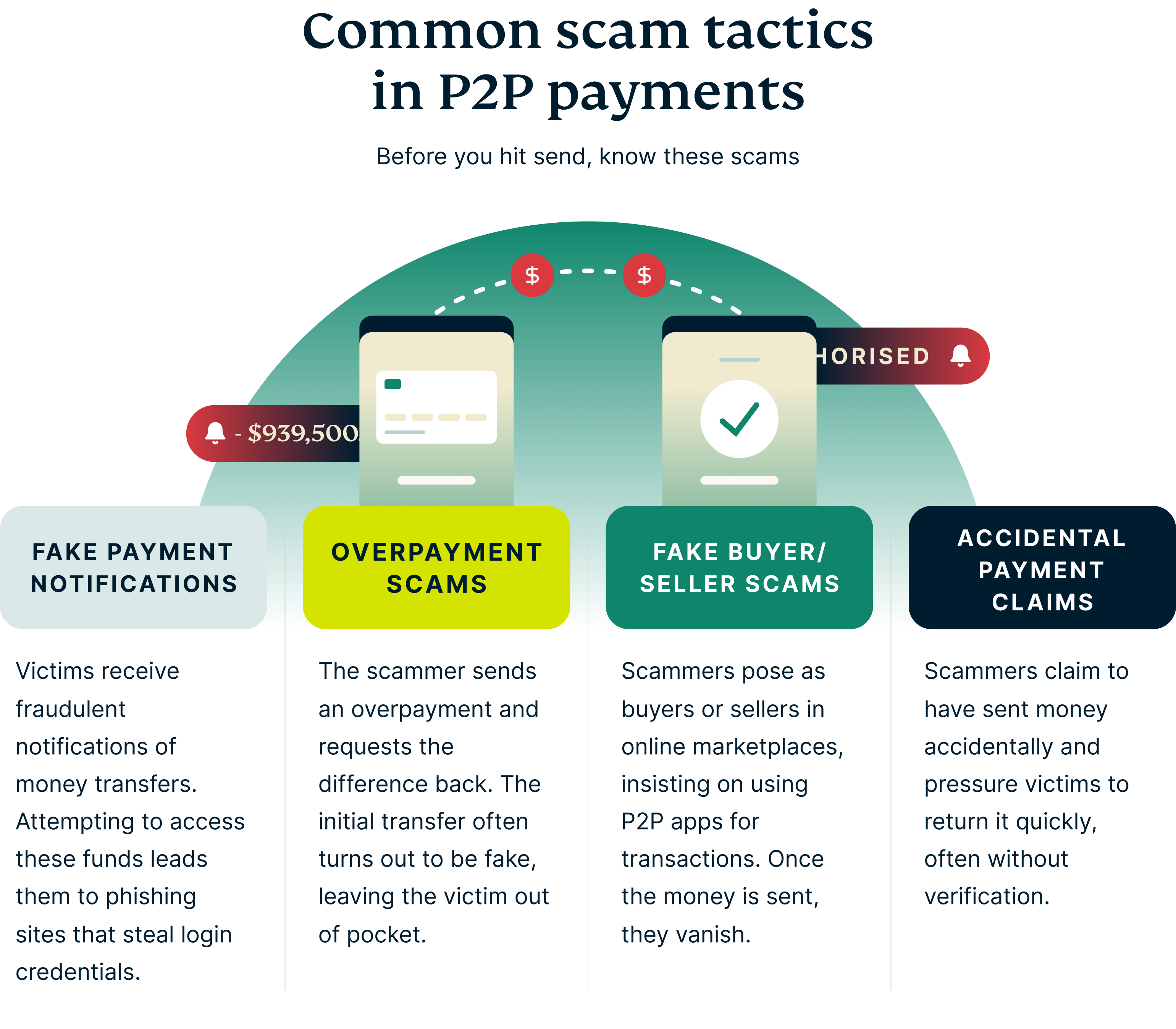

4. Peer-to-peer (P2P) payment scams

Peer-to-peer (P2P) payment apps like Venmo, Zelle, and Cash App have become ubiquitous for quick and easy transactions. However, this convenience has also attracted scammers, leading to a rise in P2P payment scams. These scams typically involve deceiving users into sending money or divulging personal information for fraudulent purposes.

A notable instance of P2P scams is the recent surge in fraudulent activities on Zelle. Reports have highlighted a marked increase in scams on this platform, underscoring the potential risks for users. The gravity of the situation was such that it garnered the attention of Senator Elizabeth Warren, known for her stance on strengthening consumer protections, particularly in the realm of P2P payment services.

The mechanics of these scams can vary, but they typically follow a pattern designed to deceive and exploit:

Protect yourself from P2P payment scams:

- Transact with trusted individuals only: Limit transactions to people you know and trust. This approach helps avoid common scams like fake buyer or seller schemes and overpayment frauds.

- Verify recipient details: Always double-check the recipient’s information, including their name, email, and phone number, before transferring funds to prevent sending money to imposters.

- Beware of unsolicited requests: Be cautious of unexpected requests for money, particularly from unfamiliar individuals. These are often disguised as urgent money transactions, attempting to make you act quickly and without thinking.

- Avoid suspicious links and attachments: Do not click on links or open attachments from unknown sources, as these could be phishing attempts aiming to steal your login credentials.

- Report suspicious activity: If you encounter anything unusual, report it immediately to the P2P payment app’s support team and law enforcement authorities. This helps track down scammers and prevent further victimization.

5. Package delivery scams

While package delivery scams often spike during the holiday season, their threat persists well into the new year, capitalizing on the continued excitement and anticipation surrounding online shopping. These scams are not confined to the festive season; they remain a prevalent issue, exploiting consumers’ trust in delivery services and online retailers. A recent incident involving delivery company UPS underscores how these scams operate and their impact.

In Florida, residents were targeted by a scam involving a fake UPS package delivery notifications. The scammers informed residents that they were expecting deliveries, which, in reality, didn’t exist. This type of scam typically uses phishing techniques, where victims are sent messages that appear to be from legitimate delivery companies like UPS.

These scams often begin with text messages or emails claiming to be from delivery services. The messages might state that you have a package waiting or that there’s an issue requiring your attention. Here’s how they generally unfold:

Protecting yourself from package delivery scams:

- Verify delivery notifications: Always check directly with the delivery company through their official website or app rather than clicking on links in unsolicited messages.

- Avoid unsolicited packages: If you receive a package you didn’t order or a request to pay for an unsolicited delivery, be cautious. Report any such incidents to the delivery company and avoid interacting with suspicious messages.

- Research and payment methods: When shopping online, ensure the store’s legitimacy and use secure payment methods like credit cards, which often offer fraud protection.

- Report suspicious activity: Be aware of the signs of a scam, such as messages creating a sense of urgency or asking for sensitive information. Report any suspicious activities to the relevant authorities.

Other scams to be aware of in 2024

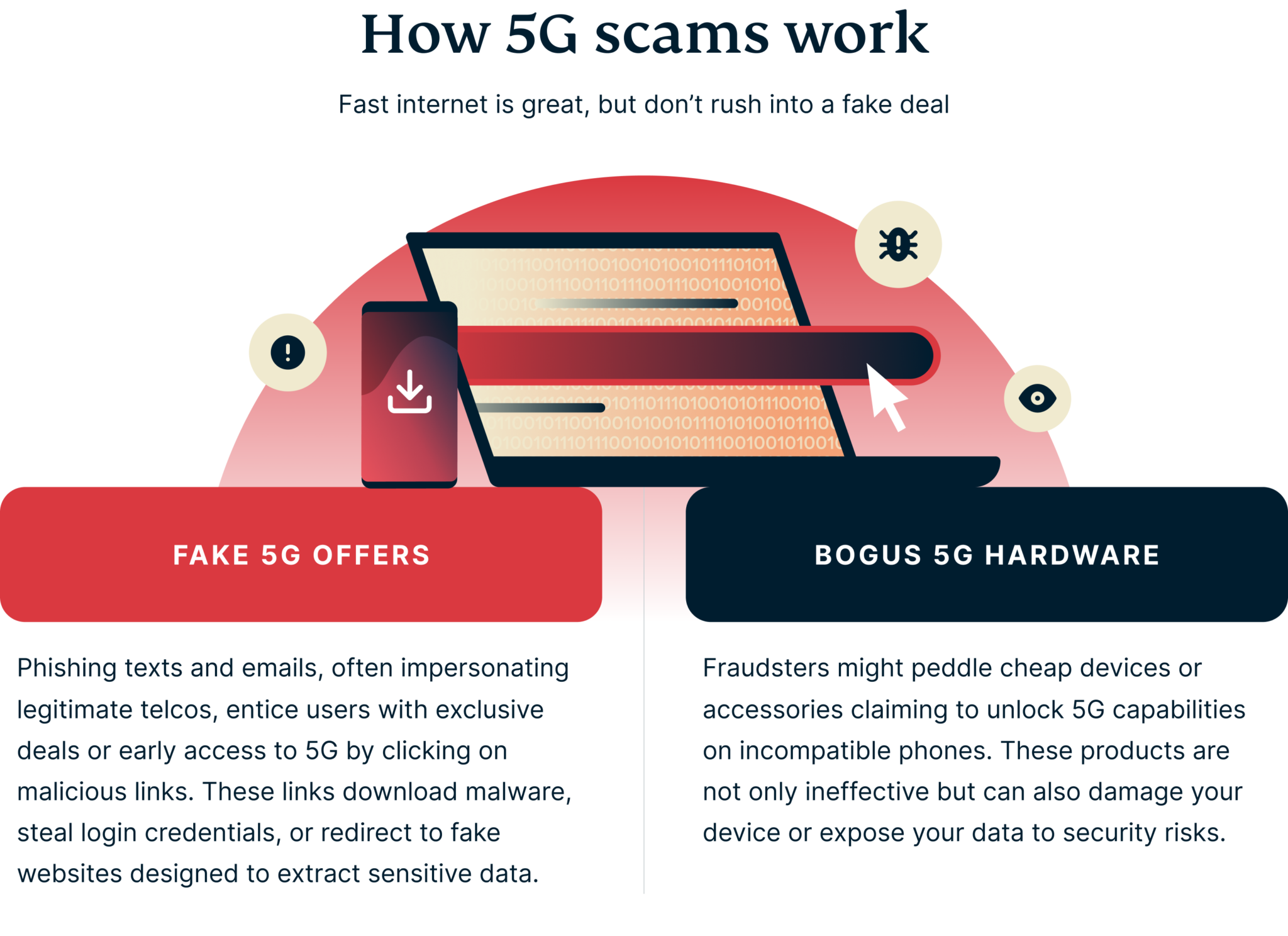

5G-related scams

The excitement surrounding 5G’s lightning-fast speeds and game-changing potential has, unfortunately, attracted its fair share of scammers. These con artists prey on consumers’ eagerness to jump on the bandwagon, deploying a variety of tactics to steal money and personal information.

Protecting yourself from 5G-related scams:

- Don’t fall for false promises: Be wary of sensational claims about 5G unlocking life-changing benefits. Always check official sources from your mobile service provider or trusted tech websites for accurate information about 5G availability and capabilities.

- Beware of unsolicited offers: Legitimate providers won’t pressure you into upgrades or offer exclusive deals through suspicious links or phone calls. Be cautious of such solicitations.

Celebrity endorsement crypto scams

Celebrity endorsement crypto scams exploit the public’s trust and affinity for their favorite stars to fuel a dangerous web of deceit. Imagine scrolling through social media and seeing your idol raving about a supposedly “guaranteed-to-skyrocket” new cryptocurrency. They paint a picture of financial freedom, effortless gains, and joining an exclusive community. This is the initial hook, where excitement masks the red flags.

Behind the scenes, celebrities are often paid hefty sums to promote these risky ventures, rarely disclosing the hidden risks or their own lack of crypto expertise. This creates a false sense of legitimacy, luring unsuspecting fans into believing the celebrity genuinely believes in the project.

Protecting yourself from celebrity crypto scams:

- Follow the money: Just because your favorite celebrity promotes a crypto project doesn’t automatically make it legitimate. Remember, celebrities are often paid handsomely for endorsements, and their financial interests may not align with yours. Dig deeper into the project’s whitepaper, team background, and any potential red flags identified by independent reviewers.

- Beware of urgency and scarcity tactics: Scammers often create a sense of urgency by claiming limited availability or promising imminent price increases. Don’t let pressure cloud your judgment; take your time to research and evaluate any cryptocurrency investment.

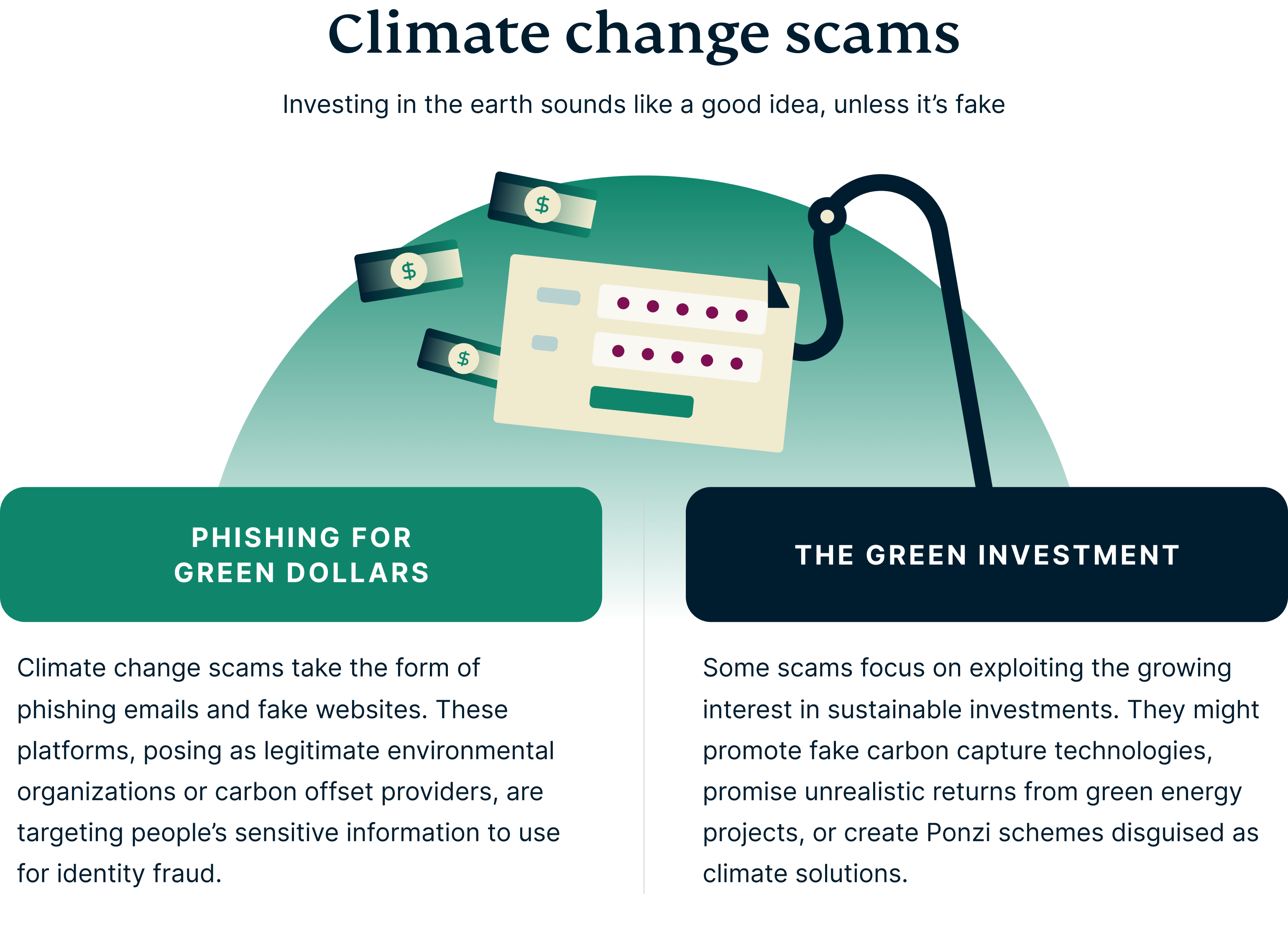

Climate change scams

Climate change, a pressing global challenge, has unfortunately also become fertile ground for scammers. Preying on anxieties and the desire to be part of the solution, these con artists weave intricate webs of deceit masquerading as eco-friendly initiatives.

Protecting yourself from climate change scams:

- Beware of emotional manipulation: Scams often use guilt trips, fear-mongering, or urgency tactics to pressure you into quick decisions. Stay grounded and avoid acting impulsively. Remember, genuine action should empower, not manipulate.

- Be alert of green investment scams: Avoid investing in untested technologies or green energy projects promising unrealistic returns. Conduct thorough due diligence, check regulatory approvals, and understand the risks involved before investing in any climate-related solution.

Charity scams exploiting global crises

Global crises, from natural disasters to humanitarian emergencies, evoke a powerful urge to help. Scammers, however, exploit this compassion for their own gain, weaving elaborate webs of deceit disguised as charitable efforts.

Protecting yourself from global crises scams:

- Always verify before donating: Verify the legitimacy of a charity through independent resources like Charity Navigator or GiveWell. If you are planning on donating, avoid sending cash or using unverified online platforms to donate.

- Don’t donate to personal accounts: If you notice that the donation portal leads you to a personal account instead of a business account associated with the charity, do not transfer any money.

Fake healthcare insurance plans

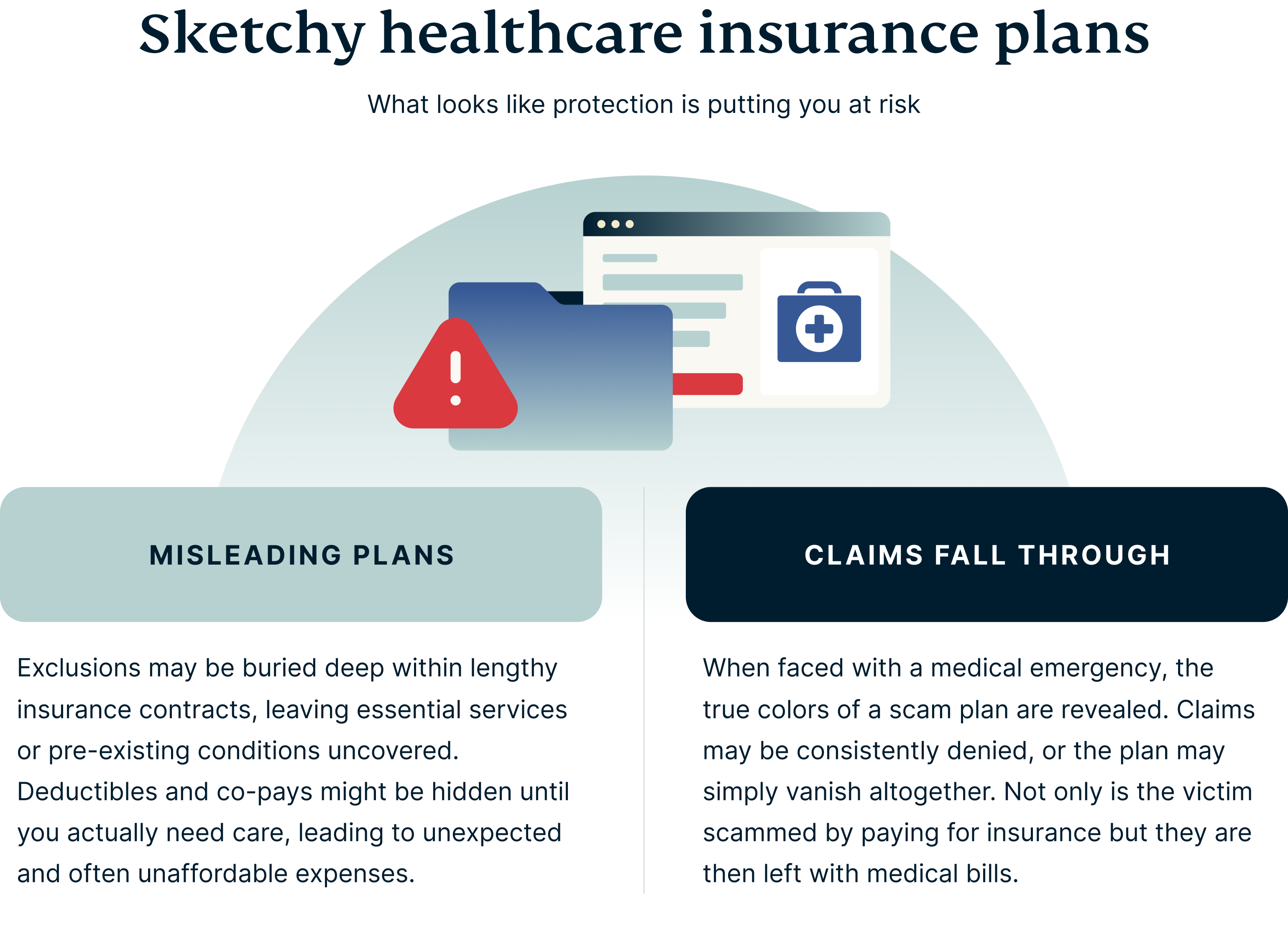

Fake healthcare insurance plans, much like their namesake, offer nothing but an illusion of security. They may promise comprehensive coverage at rock-bottom prices, but in reality, they leave you vulnerable to significant medical bills and potential legal trouble.

Protecting yourself from fake healthcare insurance plans:

- Read the fine print carefully: Always verify the legitimacy of an insurance plan with your state insurance department or a trusted healthcare provider. It’s also worth understanding the plan’s coverage, exclusions, deductibles, and co-pays before signing up.

- Never share personal information with unsolicited callers or websites: Legitimate insurance providers and agents will never request for personal information over the phone. A reputable insurance provider will always verify your identity and request information through secure channels before providing any service or discussing sensitive details.

Understanding the psychology of what makes people fall for scams

A 2023 Citibank survey revealed that while 90% of U.S. adults feel confident in their ability to identify and avoid scams, over a quarter still fell victim to one during the year. So why does this happen?

Optimism bias makes us vulnerable to scams

A key psychological factor contributing to why people fall for scams is optimism bias. This bias leads individuals to believe they are less likely to be affected by negative events compared to others. In the context of scams, this manifests as an overconfidence in one’s ability to detect and avoid fraudulent schemes. Unfortunately, this can result in a lowered guard against potential threats.

Optimism bias can make people more vulnerable to scams as they might not be as thorough in scrutinizing potential risks. They could disregard warning signs such as unsolicited contact, under the assumption that they are too savvy or informed to fall victim. This mental blind spot is precisely what scammers exploit.

How technology contributes

Another factor contributing to susceptibility to scams is the level of technological expertise. Individuals not fully acquainted with the latest technological advancements or trends might be more prone to scams due to a lack of understanding of how these fraudulent operations work. Scammers often leverage new technologies and methods, staying a step ahead of the general public’s awareness.

Tactics scammers use to trick their victims

Time pressure

Scammers often create a sense of urgency to provoke rash decision-making. For example, consider a scenario where you receive a call from someone claiming to be from your bank, alerting you to unauthorized activity in your account. The immediate threat to your privacy triggers a natural response to regain control, often leading to hasty actions that scammers capitalize on.

Abusing trust and authority

Authority figures naturally command trust. Scammers exploit this by impersonating officials or known authority figures, thereby lowering your guard and making their deceit more believable. An example is a scam email from a “manager” requesting the purchase of gift cards in an emergency, a typical scenario in the workplace.

Promising financial gain

Despite knowing that free offers usually have a catch, many still fall prey to scams promising easy money or exclusive deals. Scammers capitalize on the fear of missing out (FOMO) and the allure of quick financial gains, which can be particularly effective against those in financial distress or seeking emotional validation.

Recognizing that these strategies can overlap and amplify each other helps us understand why scams can be so effective. This knowledge is a key step towards recognizing the red flags of scams, which brings us to our next section.

What are the warning signs of a scam?

Recognizing the signs of a scam is crucial in protecting yourself from falling victim to one. Here are some key red flags to look out for:

Have you ever fallen victim to a scam? Share your experience in the comments below.

FAQ: About scams to look out for

What are some common scams I should be aware of?

Scammers are constantly developing new ways to steal money and personal information. Here are some of the most common scams to be aware of:

– Phishing: This involves sending emails, text messages, or social media messages that appear to be from legitimate companies or organizations. The messages often contain a link that, when clicked, will take you to a fake website that looks like the real one, asking you to enter your personal information.

– Catfishing: Catfishing refers to the act of creating a fake online persona or identity, often using dating apps, to lure and deceive others into forming relationships or engaging in fraudulent activities.

– Crypto scams: A crypto scam refers to fraudulent schemes or activities within the cryptocurrency space, where individuals or organizations deceive others by promising high returns or opportunities related to cryptocurrencies, but ultimately aim to steal money or sensitive information.

– Fake products for sale: A scammer could set up a fake shopping website or use platforms like Facebook Marketplace to get you to buy something that never materializes.

– Charity scams: A charity scam is when someone solicits donations for a charitable cause, but misuses or pockets the money for personal gain instead of using it for the intended charitable purposes.

– AI or deepfake scams: Deepfakes use AI to make videos or audio seem real, even if they’re fabricated. Scammers might put celebrity endorsements on fake products or create false news to manipulate you. Some of these AI-powered websites and apps might also secretly collect your personal information or trick you into clicking malicious links.

How can I protect myself from scams?

There are several things you can do to protect yourself from scams:

- Be wary of unsolicited offers. If you receive an offer that seems too good to be true, it probably is.

- Never share your personal information with anyone you don’t know and trust.

- Be careful about clicking on links or opening attachments in emails or text messages, even if they appear to be from legitimate companies or organizations.

- Keep your software updated, including your operating system, web browser, and antivirus software.

- Do your research before investing in anything. An unsolicited tip is almost definitely a scam.

- Be cautious about relationships built online; they might not be who they say they are.

- Limit the number of scam messages you get by avoiding giving out your email and number.

What should I do if I think I’ve been scammed?

If you think you’ve been scammed, here are several things you should do:

- Alert your bank: The sooner you inform your bank or credit card issuer about the suspected scam, the higher the chance of reversing the charge. Explain the situation and ask for their assistance in dispute resolution.

- Consider card cancellation: If you suspect your card details were compromised, canceling the linked card might be wise. This prevents further misuse and offers a fresh start with a new card number.

- Report to the FTC: Let the authorities know! Share your encounter with the Federal Trade Commission through ReportFraud.ftc.gov. Your input helps track and combat scammer activity.

- Password refresh: If passwords across platforms are shared, act quickly! Update your online banking and credit card logins with unique, strong passwords to prevent cross-platform breaches.

- Credit watch: Stay vigilant and monitor your credit report regularly. AnnualCreditReport.com lets you access free reports from all three major bureaus. Report any suspicious activity promptly to protect your financial health.

Remember, by acting swiftly and following these steps, you can minimize the damage from a shopping scam and help fight back against these deceptive practices.